- Muhammad Habib

- Sep 18, 2025

- 13 min read

Updated: Jan 5

I am going to go through how Merrill Lynch is defending itself with their Statement of Answer in this claim. I want to point out that you don't need to be a securities attorney to understand Reg BI. You need to be eligible for jury duty and have $5,000 in a 401k or IRA or a regular account at Vanguard, Schwab, Morgan Stanley, etc. You just have to be a retail customer. This is a plain English rule. If you are a retired teacher or a truck driver you are a Reg BI expert.

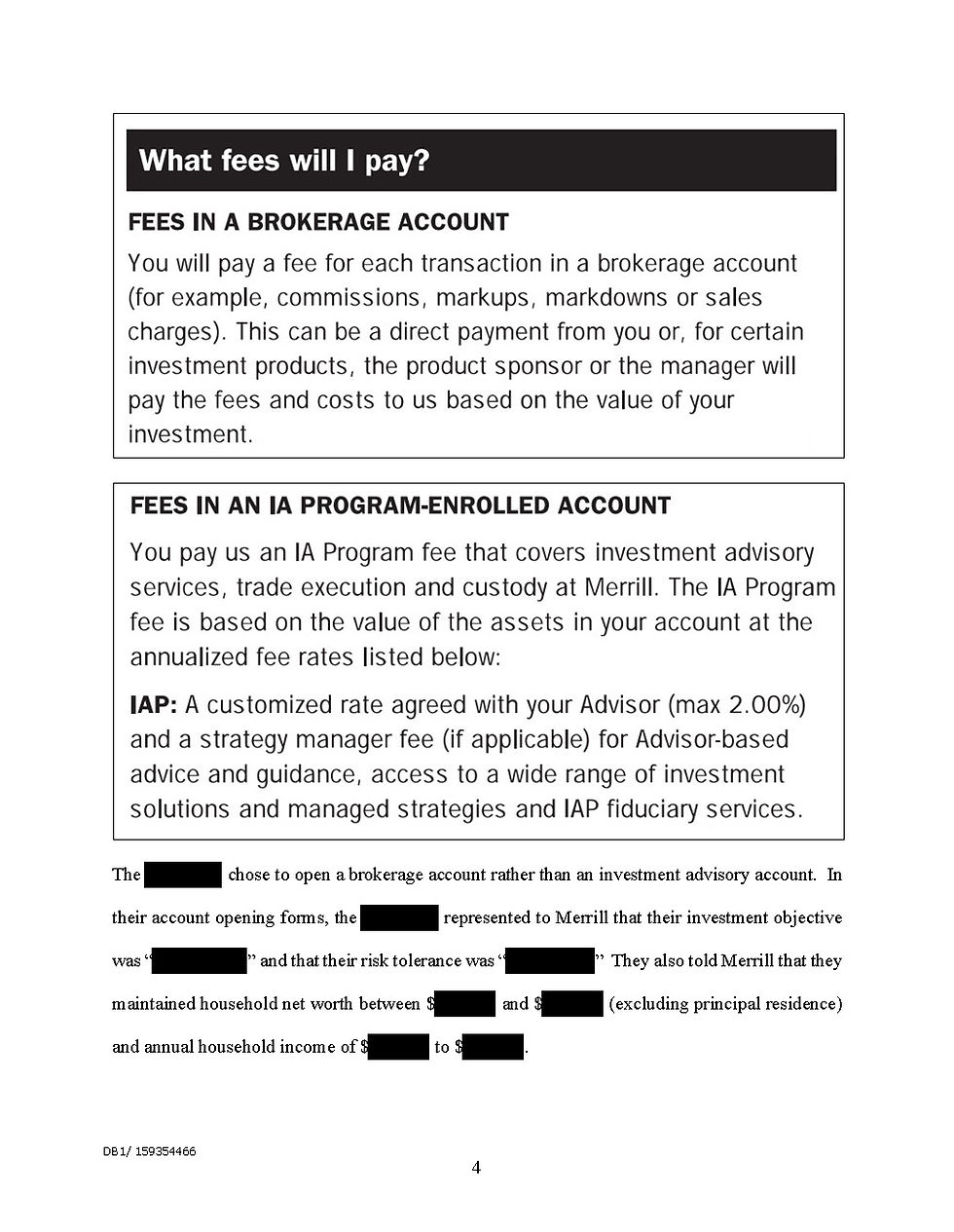

The next four pages is the Merrill Lynch Client Relationship Summary (CRS) with my notes interspersed. All firms are required to create and send out as a CRS as way to let clients know there is a rule called Regulation Best Interest and a summary of how the rule works. Below is the one from 2022. (You can google "Merrill CRS" to see how it looks today.) The font is pretty small and you have to concentrate.

Reg BI specifically says the CRS does not provide enough information to make a choice but instead, it is a starter. I want you to see how it looks and contrast that with how Merrill Lynch makes it look in their statement of answer. I will give you a hint. In the Statement of Answer, they cut and paste the CRS out of order and magnify the font by 20x or so- to possibly confuse the single arbitrator in a zoom hearing. It is very likely the arbitrator will have a large screen and see the form as the Merrill statement of answer displays it. This is not how a customer see it.

They are resting their case on the fact that the client made an active choice to CHOOSE brokerage and not advisory from this CRS.

You have to understand that the industry doesn't want to give up brokerage accounts (spoiler alert-it is because of the extra money). They don't want to disclose information to their customers as the rule requires. Once you understand that, you will understand the motivation behind how they will do whatever they can to NOT TELL their customers they have the option to put any product into an unconflicted advisory account. When you go thru this, I am going to point out what Merrill Lynch is NOT DOING.

Just to preface this, what you are going to read is that Merrill Lynch is trying to prove to a customer-after the fact- that the customer was given sufficient information to make an active choice- and did make an active choice- and chose a brokerage account and not an advisory account. The customer- who is going to raise his right hand and testify- will say- he had NO idea he had the option of an advisory account. The customer will say he never made a choice.

If you see the box below, Merrill Lynch blows up that line and highlights it is red in their statement of answer. They are trying to pretend the customer had sufficient information from this form to choose brokerage and not advisory. The customer glanced at this page if he opened at all - possibly on his phone- and the words in the box are not exactly highlighted. They are squished in the middle.

There are several problems with Merrill Lynch "CRS" approach.

1) Reg BI itself says the CRS is not enough. They knew the industry would try to get cute. The Disclosure Obligation requires broker-dealers and associated persons to disclose “all material facts relating to the scope of the terms of the relationship,” (emphasis added in rule) and broker-dealers and such associated persons thus will need to consider, based on the facts and circumstances, whether there are other material facts relating to the scope and terms of the relationship with the retail customer that need to be disclosed. This analysis generally should include consideration of whether information in the Relationship Summary constitutes a “material fact” that could appropriately be expanded upon in satisfying the Disclosure Obligation. It would be possible, but would be unlikely for most broker-dealers, for the abbreviated format of the Relationship Summary to sufficiently disclose “all material facts” regarding the scope and terms of the relationship such that no further information would be required to satisfy the Disclosure Obligation. (page 144)

2) At the time the CRS was sent, the broker had not made any reccomendations and the customer had not decided which account to put the future reccomendations in. How can Merrill Lynch say the customer chose something that has not been offered yet.

3) Everyone deletes the CRS anyway. Advisors Say Clients Not Responding to Form CRS Wendy Lanton, the chief compliance officer with Lantern Investments in Melville, N.Y., also hadn’t heard of any clients using the conversation starters to ask questions of advisors (in addition to the Form CRSs sent through their custodian, Lantern herself mailed hundreds of forms to clients). “Customers get stuff in the mail all the time, they open it up and throw it in the garbage,” 8/17/20 -

4) Here is what actually happened. "Jon" (the client) was talking with his wealth manager and cost- of course came up- how much does BREIT and BCRED cost? His wealth manager said verbally the S share (brokerage share class) and a 1% placement fee. It is important to mention what the Merrill Lynch manager didn't say. He didn't mention anything about the advisory share class (i share). He didn't say there were two ways to pay. He only mentioned the S (brokerage) Share class and a 1% placement fee.

The customer spoke to his wealth manager, received an answer and put it out of his mind. When the subscription document came, the first "click" said the "S" share (brokerage share class) and a 1% placement fee. It matched what his wealth manager said- ... so.....Jon and his wife signed. Jon had no idea Merrill was sending him mail and was using the -unopened mail- to prove after the fact that Jon made an "informed decision" and chose brokerage and not advisory.

Merrill Lynch is stuck and has to pretend that there was an entire conversation about brokerage vs. advisory and that Jon had enough information to make an informed decision and chose brokerage and not advisory. Jon thinks Merrill is lying and is looking forward to proving that in arbitration.

5) This gets to the heart of Reg BI. Merrill can only take an order if it was an informed decision. Jon had no idea there was an advisory share class. Merrill Lynch never suggested an advisory fee. He was never given a chance to negotiate the advisory fee. He never thought about an advisory account. He trusted his personal wealth manager who told him the pricing was a 1% placement fee and the "S" share class. Merrill Lynch is claiming that the client has to disregard what he heard from his wealth manager and search every Merrill Lynch email and mail for a different way to pay. That is not "full and fair."

Below is page 3. You can see the black boxes and will see how Merrill Lynch blows them up in size and highlights them in their Statement of answer (a few pages below) . They pretend these two boxes take up almost an entire page. They pretend the CRS document is different than the retail customer sees it.

Merrill Lynch is tying itself in knots to pretend they received an informed decision from Jon, when they intentionally didn't mention the advisory account.

Below is page four. Merrill Lynch is saying the customer read all four pages, understood the implications, received enough information, and CHOSE brokerage. There were actually another 9 pages of legalese in the mail/email. Jon and his wife think this is ludicrous. They had a simple conversation with their wealth manager. He told them the cost in a verbal- (let's call it an) "intentional compensation conversation." He only mentioned the brokerage account.

This is how customers want information. They hear it verbally from their investment professional and then the subscription document that they sign has the same numbers in writing as the investment professional quoted in the conversation.

This gets to the heart of Reg BI and the fact that the person who decides if the information they were given was "full and and fair" and "ALL material information" and "sufficiently specific" and "important" is the retail customer.

Merrill Lynch knows that and they know that if the investment professional starts having a conversation and suggests two ways to pay, it will get very confusing for the customer. Customers don't like confusing and it is very possible this customer would have taken his business elsewhere.

Here is the first page of the Merrill Lynch statement of answer. (June, 13, 2025)

If you see below, Merrill Lynch magnifies one line - kind of sandwiched in the middle of the real CRS (see above) - and outlines it in red below for the arbitrator. They also say that the customers were required to "review and acknowledge" the CRS. Merrill hasn't provided any proof of an acknowledgement. There is no industry requirement for anyone to acknowledge the CRS. The customers almost certainly deleted the CRS or maybe glanced at it - possibly on their phone. Merrill does mention that the form is in plain language. Merrill doesn't claim plain language with their other "proofs" of comparison between advisory and brokerage.

Compare the below page (page 4 of Merrill SOA) with how the actual page 3 of the real Merrill CRS actually looks. Merrill magnifies the text at least 20x so that two small paragraphs make up an entire page. Merrill Lynch then says that the customers CHOSE (they don't say he made an informed decision) use the language to open a brokerage account and not an advisory account from the CRS alone. Jon and his wife had no idea they just made a choice. We will see that Merrill Lynch keeps referring to this "choice" in their statement of answer. In all likelihood, the customers never opened the document. The husband is sure the the investment professional never told him about advisory vs. brokerage- AT ALL. He didn't make a choice and they never claim that he made an informed decision.

Merrill Lynch sends a letter 2/4/22 - a few weeks after they sent the CRS- which was tossed in the garbage with the other junk mail that week. Customers get weekly mail and weekly email from the insurance company, the car lease company, the bank, Merrill Lynch, etc. If they had to sit down and try to find the catch with every company, they would have no life. No one has the time or the legal background to read all of the "protect the firm" mail they receive. Merrill says the letter didn't cause the customer to "rethink their decision" (ML again doesn't use the language informed decision ML never claims they received an informed decision and yet that is what Reg BI requires.)

It is important to mention again what Merrill Lynch didn't do. Merrill Lynch could have sent a letter by FedEx or by registered mail. Reg BI requires Merrill Lynch to provide an explicit comparison between brokerage and advisory. It is important to see what Merrill Lynch failed to provide. Merrill Lynch didn't want Jon to know about the advisory account option.

Customers know- if it important, some one calls them. The Merrill Lynch wealth manager never called to say, "hey, open that document and let's discuss pricing in advisory vs. brokerage"- The person who decides if the ML communication was "full and fair" and "sufficiently specific" and included ALL important information so that the customer can make an informed decision is THE RETAIL CUSTOMER. Merrill Lynch can't take an order unless it was an "INFORMED DECISION."

This letter had about 15 pages of legalese including the four page CRS. The customers are under no obligation to read or ask Merrill Lynch anything. The new rules require Merrill Lynch to get an informed decision. If a client asks questions, it helps Merrill Lynch, but Merrill can't take an order until a customer has sufficient information to make- and does make-an informed decision.

Importantly, they refer below to the "decision" that was made when the customers were sent the original CRS. Merrill Lynch doesn't claim this letter made the customers decide anything.

The customers have no clue Merrill is using this "junk mail/disclosure letter" to talk about something as important as pricing and incentives. They have no idea their portfolio would be much more diverse in an advisory account. Merrill put 100% of the assets into BREIT and BCRED. In advisory, they would have had 8-10 investments with a much lower concentration.

Reg BI says that clients don't understand the implications of conflicts. This is a perfect example. Their investment professional never called to say there was something important sent and lets review it. The customers have no idea that Merrill Lynch is not explicitly comparing the advisory and brokerage share classes. Again, Merrill says this letter "did not cause the customer to rethink their decision"- huh? what decision? I note that Merrill Lynch doesn't say "rethink their informed decision." The customer doesn't know that his portfolio would be much more diverse in an advisory account.

At the bottom of the page, Merrill Lynch gets even more creative. In the real subscription document, the first "click and sign" is the order details which says a 1% placement fee and the "S" share class. 11 clicks / 4 pages later is the fee disclosure. Merrill is making it look to the arbitrator that the "order details" and the "fee disclosure" are right next to each other. Merrill puts thought into how customers sign. They know the customers are looking for the terms that their wealth manager told them verbally. Once they see the same terms- in this case a 1% placement fee and the "S" share class, they relax and click through the rest of the document without much thought. Merrill is doing whatever they can to put the customers to sleep in order to sell the brokerage share class.

Merrill Lynch gets even more audacious below. The customers signed that they RECEIVED the OM. (They don't include that signature in the SOA) Merrill then goes on to say the husband "affirmed" that he actually received and READ each OM- 300 pages each. The husband has NO IDEA what Merrill Lynch is talking about. When and how did he affirm that? Merrill Lynch has provided no proof that the customer affirmed he read the two OM's. To make this sharper, the wealth manager is trying to get a sale. Do you think he called Jon just before Jon was about to sign and said- "hey, you read both of the the 300 page OM's, right"- that would have raised all kinds of red flags in Jon's mind.

Merrill seems to think they can get out of their responsibility of getting an informed decision by saying the customer affirmed an understanding to "read, understand and discuss any questions with the investment professional"- where exactly are they pulling that language from? What is ML talking about? If the customer raises questions with the investment professional, that helps the investment professional/Merrill Lynch receive an informed decision, but if not, the investment professional has to make sure the customer has all the important facts - in a way that the customer can understand them. The investment professional has to make sure the customer makes an informed decision. Merrill never claims they received an informed decision. This missing language proves ML culpability.

Can you imagine the broker calling the customer -an hour before he sends the customer the subscription documents- hey, I need you to confirm that you read the prospectus? The client would perk up and say why? Wealth managers know exactly what to say and what not to say. Reg BI forces Merrill Lynch to tell the clients everything in a way they can understand it. This customer will raise his right hand and say he was never asked if he read the OM. Merrill Lynch's SOA dissolves in front of the slightest understanding of how the sales dynamic works in the business.

Jon never saw the below chart on page 7. The below chart is from the OM. Merrill added it because Merrill is claiming that Jon read the OM. However, Jon didn't read the OM. Nor was he asked if he read the OM. Nor did he affirm that he read the OM. He would not have understood it anyway as he would have fallen asleep on page 2. Jon feels Merrill Lynch is so far away from having proper rules in place to comply with Reg BI that they are forced to say Jon affirmed something that never happened. Merrill is cutting and pasting from the OM something the customer never looked at.

Below Merrill Lynch again admits it is in violation of the disclosure prong of Reg BI by their language. If you violate any of the four prongs, you violate the rule. They say they provided the claimant with a fulsome description of the differences.

(Beginning of the second paragraph). They need to provide a "full and fair disclosure of all material facts related to the scope and terms of the relationship with the retail customer" AS DEFINED BY THE RETAIL CUSTOMER. The attorney searched for a word that sounded like "full and fair" and came up with fulsome. This is a joke! They say a sentence later that they provided this before and after the claimants decision- not an informed decision.

They say the conflicts were "amply disclosed" - they are afraid to say reasonably disclosed as Reg BI was upgraded from reasonably disclosed to "full and fair"- but they know they haven't hit the "full and fair" hurdle so they make up a new term- found nowhere in Reg BI and they call that "amply disclosed".

Below is an important document as it proves how retail customers process information. Retail customers/regular people are bombarded with letters and emails from companies they do business with. No one opens them. Certainly no one reads them. In the case below, a person leased a car from Nissan. They get mail regularly from Nissan, their other car lease companies, their insurance company, their bank, their investment provider, etc. This customer thinks Nissan sent them at least five, but probably closer to a dozen emails or letters since they started the lease August 1st. They tossed or glanced at the letters when they opened the "pile" Sunday evening.

They hadn't paid Nissan and Nissan had to tell them that before they started proceedings. Nissan sent a letter by CERTIFIED MAIL to get his attention. When it is important, NISSAN sent them a letter by CERTIFIED MAIL so that they would know to open it and read it and think about. Merrill Lynch is well aware that retail customers are inundated with mail and email. Merrill Lynch knows they have to get their customers attention when it is important and material. Merrill Lynch has a salesforce that interacts with the customer. Merrill Lynch could have sent a certified letter and required the customer and the wealth manager to jointly sign.

Merrill Lynch is required to tell the retail customer ALL important information in a way that the retail customer wants it delivered. Merrill Lynch is being cute by pretending that the regular mail letter they sent was opened. Big companies like Nissan and Merrill Lynch sell to retail customers. They know when something is important, the burden is on them to make sure the customer has all important information. Big companies know, that when it is important, regular mail doesn't cut it. Merrill Lynch is intentionally not disclosing to their customers enough information. They didn't give this customer enough information to make an informed decision.