Private Equity funds (Fees glorious fees) Sit down for this one!

- rd12661

- Mar 2, 2021

- 6 min read

Updated: Dec 30, 2025

If you invested in a Private Equity feeder fund through any of the large wealth managers, you almost certainly have a claim under Reg BI. If you are disappointed in your fund or want to stop funding capital calls- read on. The largest firms just decided to offer PE feeder funds ONLY through brokerage accounts. That is specifically mentioned as a material limitation and violates Reg BI. The entire point of Reg BI is that the customer chooses if they want to be in an unconflicted advisory account or a brokerage account.

Can you think of any reason a customer would pay a broker so much extra - and commit to paying the broker for the 10-15 year life of the fund? If the fund does poorly, the customer is stuck paying the broker regardless. In the advisory account, the client has control the entire time and can stop paying the broker whenever he wants. Importantly, the broker has no incentive to sell a private equity fund in an advisory account. He gets paid the same in an advisory account regardless of what he suggests to the customer.

In a brokerage account, the broker turns $75 into $11,550 every single month. Maybe this is why so much private equity is being sold to retail customers.

Merrill Lynch contradicts itself in writing on how they deal with Regulation Best Interest. (June 2025 SOA in arbitration vs. December 2022 response to customer complaint)

Below is Merrill Lynch in their Statement of Answer describing Reg BI in an arbitration. They are very clear that Reg BI is about customer choice. (June, 2025.)

The Reg BI Adopting Release could not be clearer that a significant objective of the rule was to preserve a choice in brokerage services. (note: they mean customer choice between brokerage and advisory services.)

The release uses the word “choice” eighty times.

For example, the SEC stated that: “In designing Regulation Best Interest, we considered a number of options to enhance investor protection, while preserving, to the extent possible, retail investor access (in terms of choice and cost) to differing types of investment services and products.”

“After careful consideration of the comments and additional information we have received, we believe that Regulation Best Interest, as modified, appropriately balances the concerns of the various commenters in a way that will best achieve the Commission’s important goals of enhancing retail investor protection and decision making, while preserving, to the extent possible, retail investor access (in terms of choice and cost) to differing types of investment services and products.”

“Importantly, Regulation Best Interest is designed to preserve, to the extent possible, (1) access and choice for investors who may prefer the transaction-based model that broker-dealers generally provide, or the fee-based model that investment advisers generally provide, or a combination of both types of arrangements, and (2) retail customer choice of the level and types of services provided and the securities available.”

In addition, the SEC stressed the importance of preserving a “variety” of options in the marketplace. Id. at 7 (“This variety is important because it presents investors with choices regarding the types of relationships they can have, the services they can receive, and how they can pay for those services.”)

Merrill Lynch admits in a letter to a customer on 12/5/22 states that they only allow private equity feeder funds in brokerage account and not advisory accounts.

Directly below is a Merrill Lynch letter to client 12/5/22

The email further contends that Merrill violated regulation best interest (Reg BI) by not offering you the ability to invest in the funds through an advisory account. Reg Bi did not go into effect until June of 2020. In any event, Merrill has investigated this issue and determined that his decision to (only) offer your investments in the (Private Equity) Funds through brokerage accounts would not have violated regulation based interest.

The FINRA 2026 review of Reg BI is tightening the screws. BOLD by FINRA. Merrill is not only not comparing the costs and fees between brokerage and advisory, they are not allowing their salesforce to offer the advisory share class. They have to offer every security in both brokerage and advisory.

Failure to Comply With Care Obligation:

Failing to consider or compare relevant costs and fees, such as product or account-level fees, when recommending a product or when determining whether to recommend that a customer purchase a security in either the customer’s brokerage or advisory account

Failure to Comply With Conflict of Interest Obligation:

Not identifying and addressing all potential conflicts of interest relevant to a firm’s business model, including, but not limited to, material limitations on securities or investment strategies and conflicts associated with these limitations. ( Reg BI specifically says that offering brokerage and not advisory is a MATERIAL limitation- page xx of rule)

Failure to Comply with Compliance Obligation:

Failing to have written policies and procedures reasonably designed or enforced with respect to account recommendations, for example, by:

failing to detail any steps a supervisor should take to determine whether an account type recommendation was in the customer’s best interest.

How can Merrill Lynch limit choice when Reg BI mentions it 80 times. You are not allowed to only offer brokerage. The "key enhancement" of the rule is the explicit comparison between brokerage and advisory for each product and every customer. The client chooses. Let me show you the economics and you will see where Merrill Lynch is coming from.

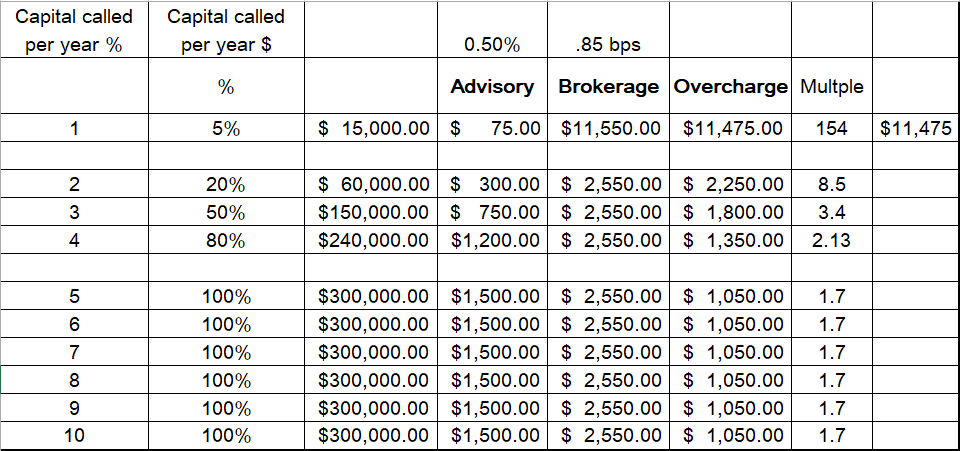

This is an example of a Private Equity feeder fund through a top 5 wealth manager.

Client committed $300,000.

The fund only invested "called" 5% or $15,000 in year one.

The customer is paying a 50 basis point fee on advisory assets.

In an advisory account, the client can stop paying the 50 basis points to "Merrill Lynch" whenever he wants. In a brokerage account, the client has to pay "Merrill Lynch" the entire 10-15 life of the fund. We are assuming the fund breaks even and ends at 10 years. Most last much longer. The underlying PE fund will get paid the entire time. Merrill Lynch gets paid the entire time in brokerage accounts, however in advisory accounts, Merrill Lynch only gets paid as long as the client is happy.

First year charges in brokerage accounts are:

1) A 2% placement fee on committed capital of $6,000.

2) A 1% revenue share on committed capital of $3,000.

3) A 85 basis point administrative fee on committed capital of $2,550.

4) Total brokerage charges in month one/year one are $11,550.

The first year wrap fee in AUM fee in an Advisory account is $75.00 (50 basis points on the 15,000 actually invested.)

In an advisory account, the wealth manager makes the same $75 he would make if the client was in the S&P or BRKB or any other stock. "Merrill Lynch" has no incentive to sell a PE fund because they get paid the same on anything. In brokerage, the wealth manager turns that $75 into $11,550 every month. If you want to know why Wall Street is selling so much private equity, you don't have to look any further.

You can probably guess why Wall Street doesn't allow these in advisory accounts.

To cite another example, if an associated person of a dually registered broker-dealer only offers brokerage services, and is not able to offer advisory services, the fact that the associated person’s services are materially narrower than those offered by the broker dealer would constitute a material limitation. (page 179 of rule)

if you are a dually licensed financial professional, you need to make a best interest evaluation taking into consideration the spectrum of accounts you offer (i.e., both brokerage and advisory accounts, subject to any eligibility requirements such as account minimums).[Rule page 10]

See Reg BI Adopting Release, supra note 3, at 33383 (“Where the financial professional making the recommendation is dually registered (i.e., an associated person of a broker-dealer and a supervised person of an investment adviser (regardless of whether the professional works for a dual-registrant, affiliated firms, or unaffiliated firms)) the financial professional would need to make [an account type] evaluation taking into consideration the spectrum of accounts offered by the financial professional (i.e., both brokerage and advisory taking into account any eligibility requirements such as account minimums), and not just brokerage accounts.”);

Unfortunately not all private equity fund do well. The clients in the dispute below wanted to be given what they would have made if they were in the public markets. The arbitrators made Merrill buy them out at face value-which is somewhat helpful but -I would argue- not what they would have gotten if they were with an unconflicted advisor who put them in the regular stock market. Don't get stuck fighting on the back end. Make sure your broker is listening to Reg BI.

The investments were in illiquid proprietary feeder funds sold by Merrill, which pooled capital in underlying private equity investments managed by firms like Apollo Global Management, KKR and Blackstone, according to Michael Bixby, a Pensacola, Florida-based attorney who represented the customers. The investments were marketed to the customers as safe products with potential annual returns of 15% to 20% but actually had average annual returns closer to 3% when factoring in fees from the private equity firms and Merrill’s administrative charges, Bixby said.

Comments